ARM Stock Performance in 2023

Table of Contents

Introduction:

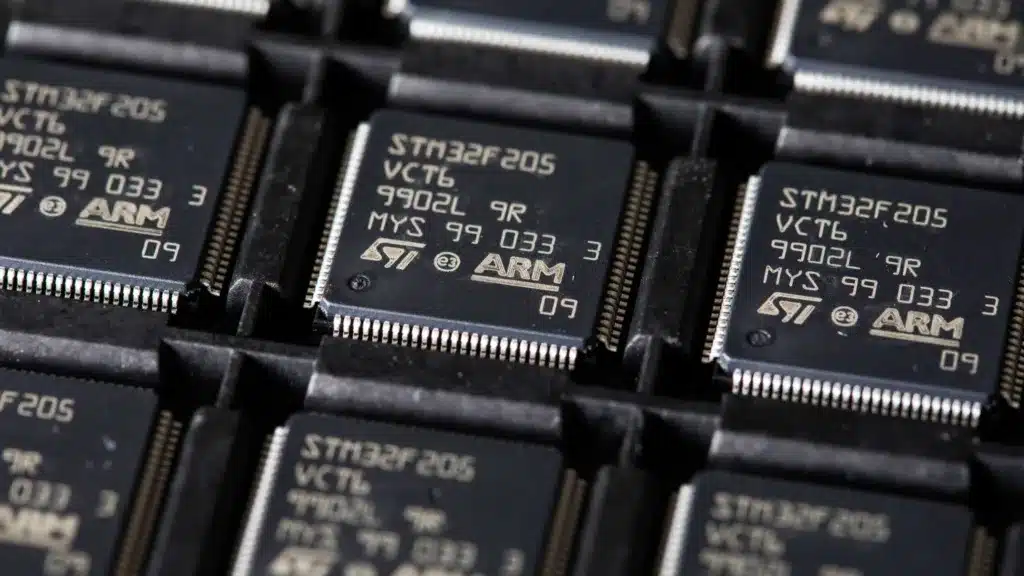

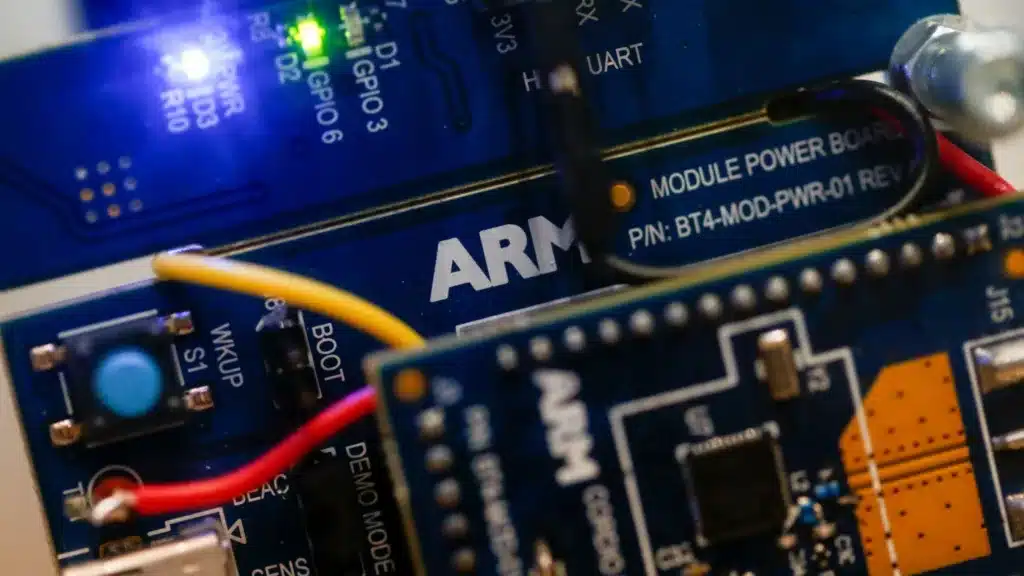

ARM Holdings, an English semiconductor and programming configuration organization, has been a conspicuous player in the tech business for quite some time. Known for its imaginative chip engineering, ARM has turned into a vital part in different electronic gadgets, including cell phones, tablets, and IoT gadgets. This article digs into the presentation and possibilities of ARM stock, analyzing its authentic patterns, late turns of events, and its situation inside the cutthroat semiconductor market.

ARM Stock Historical Performance:

To comprehend the present status of ARM stock, breaking down its authentic performance is fundamental. ARM Property was procured by SoftBank Gathering Corp. in 2016, and its stock was delisted from the London Stock Trade. Therefore, ARM is as of now not a public corporation, and its stock can’t be straightforwardly traded by individual financial backers.

Recent Developments:

In 2020, SoftBank declared plans to offer ARM Holdings to NVIDIA Partnership, a central part in the designs handling unit (GPU) market. This $40 billion arrangement raised critical worries among controllers and industry contenders, as ARM’s chip plans are authorized to various organizations across different areas, including Apple, Qualcomm, and Samsung. Administrative endorsement for the securing turned into a critical obstacle, and when of my insight cutoff in September 2021, the arrangement was still under survey.

In an amazing development, SoftBank declared in September 2021 that it was dropping the offer of ARM to NVIDIA because of administrative worries. All things being equal, SoftBank wanted to take ARM public, restoring the chance of ARM stock turning out to be public indeed. The choice to open up to the world was viewed as an essential move to hold command over ARM and exploit its worth in the roaring semiconductor industry.

The ARM Stock Semiconductor Industry:

The semiconductor business has encountered significant development as of late, determined by expanding interest for electronic gadgets, 5G innovation, computerized reasoning, and the extension of the Web of Things (IoT). ARM’s plan of action, which includes permitting its chip plans to different makers, has situated the organization well in this flourishing business sector. Its energy-proficient chip design is appropriate for cell phones and IoT applications, making ARM a fundamental player in the business.

Financial backer Contemplations:

On the off chance that ARM Holdings without a doubt opens up to the world, it could introduce a thrilling venture a potential open door for people inspired by the semiconductor area. In any case, putting resources into stocks like ARM requires cautious thought. Financial backers ought to:

Remain Informed about ARM Stocks:

Constantly screen advancements in the semiconductor business, ARM’s monetary presentation, and its serious scene.

Evaluate Market Patterns:

Comprehend the more extensive patterns influencing the semiconductor market, for example, inventory network disturbances, mechanical headways, and international variables.

Diversify:

Consider enhancing your speculation portfolio to moderate dangers related with individual stocks.

Counsel a Monetary Consultant:

Look for direction from a monetary consultant who can give custom fitted venture counsel in view of your monetary objectives and chance resilience.

Conclusion:

ARM Holdings, is a famous name in the semiconductor business, and they can possibly reappear the public securities exchange, offering financial backers a chance to take part in its development story. Notwithstanding, given the unique idea of the tech area, forthcoming financial backers ought to remain very much educated, evaluate market patterns, enhance their portfolios, and look for proficient direction to pursue sound venture choices in the semiconductor space. While ARM stock may not be openly accessible at the hour of this article, its future Initial public offering could be an occasion worth looking for educated financial backers.